Credit Risk Modeling

Making data driven decisions

Target audience of Credit Risk Modeling …

Adequately managing credit risk in institutions is critical for their survival and growth. Therefore all Institutions that lend money should be concerned about Credit risk

Banks

Loan Associations

Leasing companies

What is Credit Risk ?

The possibility that somebody, who is about to borrow money, would fail repaying it at all.

Description:

-

Credit risk arises when a corporate or individual borrower might fails to meet their debt obligations. It is the probability that the lender will not receive the principal and interest payments of a debt required to service the debt extended to a borrower.

-

On the side of the lender, credit risk will disrupt its cash flows and also increase collection costs, since the lender may be forced to hire a debt collection agency to enforce the collection. The loss may be partial or complete, where the lender incurs a loss of part of the loan or the entire loan extended to the borrower.

-

The interest rate charged on a loan serves as the lender’s reward for accepting to bear credit risk. In an efficient market system, banks charge a high interest rate for high-risk loans as a way of compensating for the high risk of default while they charge relatively lower interest rate to low-risk clients.

Why is credit risk important ?

The concept of credit risk estimation aims at correct balance of the average interest gain with expected loss, caused by defaults. Incorrectly estimated risk practically equals incorrectly priced product.

Profitability

Safety

Shareholders

Wealth maximalization

The main objective of any organization is to maximize wealth of the shareholders. Bad credit risk assertion can lead to lower wealth for Shareholders, thus decrease profitability. Do you remember or aware of 2008 recession? In US, mortgage home loan were given to low creditworthy customers (individuals with poor credit score). Poor credit score indicates that one is highly likely to default on loan which means they are risky customers for bank

IFRS 9

International Financial Reporting

IFRS 9 is an International Financial Reporting Standard dealing with accounting for financial instruments. In IFRS 9, the idea is to recognize 12-month loss allowance at initial recognition and lifetime loss allowance on significant increase in credit risk.

Regulation Basel II

International banking regulations

Basel II is a set of international banking regulations put forth by the Basel Committee on Bank Supervision, which leveled the international regulation field with uniform rules and guidelines.

Selected reference:

UniCredit Bank Czech Republic and Slovakia, a.s.

Credit Risk Modeling PI

The first goal of the project was to check the development documentation and source development codes, replicate the results of the development team.

The second main goal was to prepare validation samples, calculate validation tests and write validation documentation.

UniCredit Bank Czech Republic and Slovakia, a.s.

Credit Risk Modeling SB

During the project, we tried to make the validation process as efficient and easier as possible for future validations.

BH Securities a.s.

Critical evaluation of the Risk Management

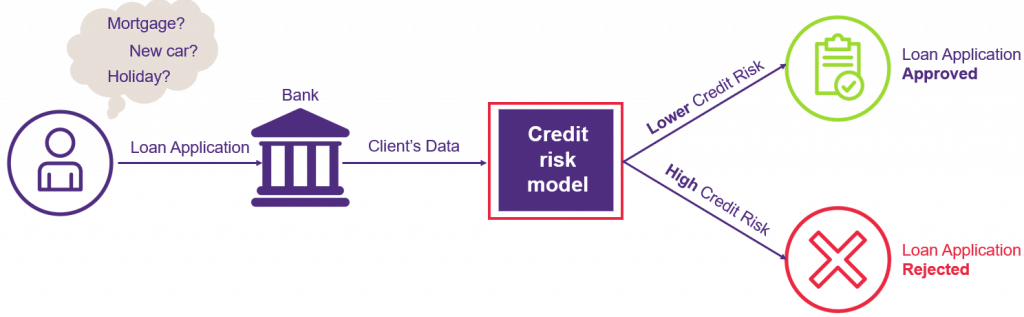

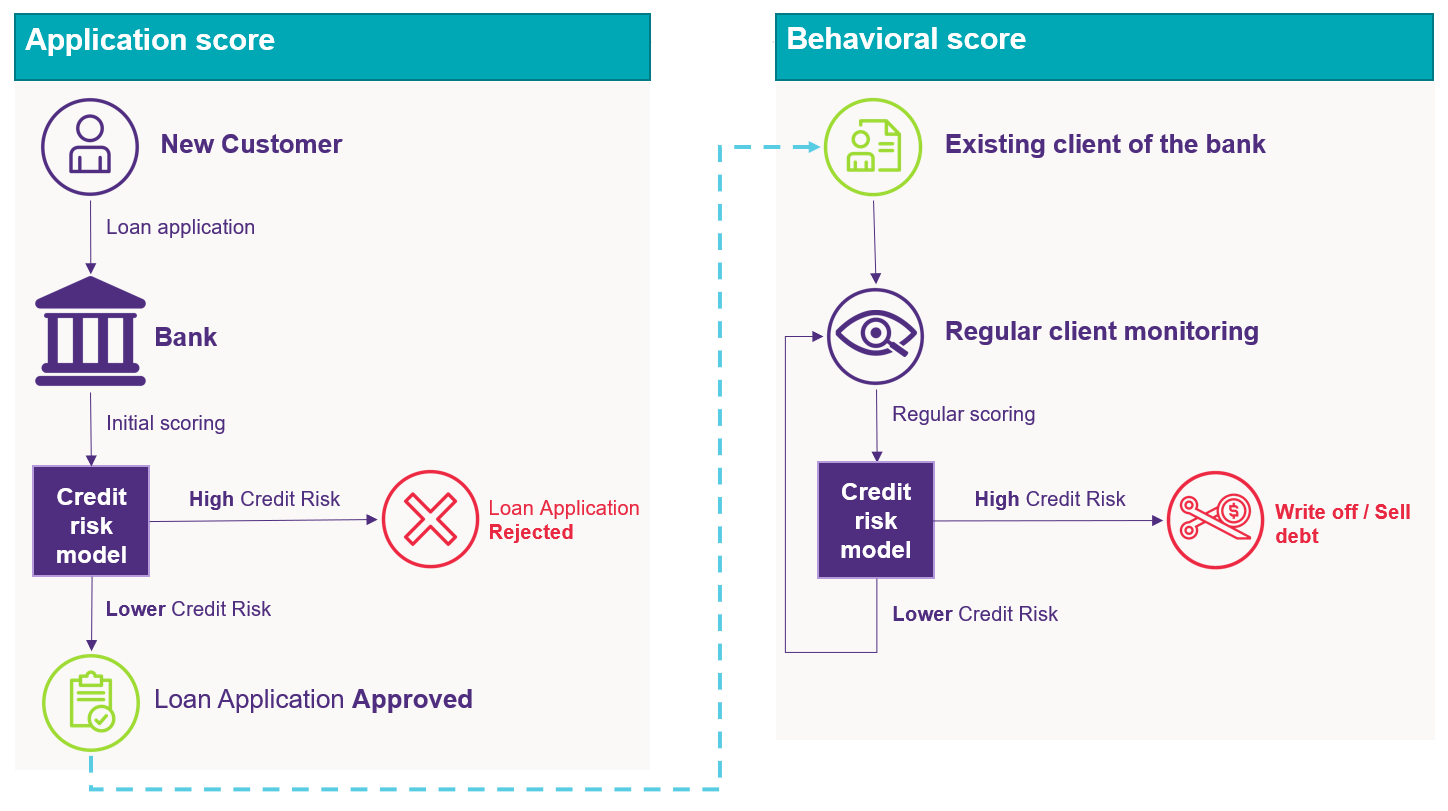

How should the Credit risk model work?

Financial institutions use credit risk models to determine the probability of default of a potential borrower. The models provide information on the level of a borrower’s credit risk at any particular time.

How it works ?

Process of credit risk modeling

The Credit risk models predict possibility that someone who has borrowed money will not repay it all.

Business, IFRS, regulatory requirement

Reasons for Credit risk modeling are either increasing profits for shareholders, meeting requirements from your auditor or regulation from National bank.

Grant Thornton may perform audit of all processes regarding credit risk.

Definition of the targets/ scope

Clear definition of the target of the new project to meet requirements.

Grant Thornton may prepare Cost Benefit Analysis of proposed changes and help with prioritization of crucial tasks.

Model Development

Developing statistical model to predict PD, EAD or LGD, utilizing historical data from the bank and other relevant sources.

Grant Thornton provides support for your internal Development team in order to create the best possible Credit Risk models.

Independent Validation

Performing statistical tests on the new developed model. Validating the development documentation. Testing performance of the model on the Validation sample.

Grant Thornton provides support for your internal Validation team in order to check newly developed model.

Supervisory Approval

National regulator reviews the developed model documentation.

Grant Thornton may create interactive reporting for CNB and management of the bank.

Model Implementation

Credit risk model is developed into a simple application which is rolled out to users (bank employees).

Periodic Monitoring

The performance of the model is periodically monitored and tested.

Grant Thornton may back-test performance of the models and suggest necessary improvements.

Model Refinement (if any issue)

If the credit risk model does not meet necessary requirements it has to be changed or redeveloped.

Grant Thornton may help redevelop your Credit Risk models if necessary.

Credit risk modeling – Developement

The key for successful development is sound database, clear business logic and unbiased final model.

Credit risk model development steps:

Data Preparation

The process of Scoring model preparation generally begins in the SQL database. Within the Financial & Data Analatycs team, we specialize mainly in the preparation of source tables for further statistical analysis, creation of advanced models and data visualization.

Model Development

The first step of credit risk model development is selection of the suitable variables. Next the statistical model is developed and tested on out of time sample dataset. Lastly the model is calibrated. The model development is usually performed in SaS, R or Python.

Documentation

The final step of the model development is creation of comprehensive Development documentation and Implementation documentation for IT firm, who implements the created model into the bank‘s systems

Credit risk modeling – Validation

Validation team performs the role of an independent tester, who challenges the Development team’s decisions, who performs checks and further statistical analysis of the developed model.

Credit risk model validation steps:

Validating Development documentation

The process of the Validation of the Scoring model begins in Development documentation. For the Validation team it is necessary to understand the developed model.

Data and model checks and statistical tests

In order for the model to predict correct results the source data need to be correct. Therefore, specific data quality checks are necessary for successful model validation. After the data are checked it is necessary to perform further statistical test on the developed model. The model must be unbiased and sound.

Documentation

The final step of the model validation is creation of comprehensive Validation documentation.

Case Study 1: Credit Risk Modeling – Validation of PD PI for UniCredit Bank

The aim of the project was to validate the newly developed PD PI model (Probability of default, private individuals’ segment).

Project description:

-

The first step of the project was to replicate the results of the Development Team and check the development documentation.

-

The next step in the validation of the PD PI model was the preparation of Data Quality checks. The aim of the checks was to reveal possible deficiencies in the raw data.

-

For the purposes of preparation of validation tests, the Validation Team prepared a complete data sample for 2018 and 2019.

-

Subsequently, the Validation Team evaluated the Validation Tests intended for the CNB and wrote the validation documentation.

Project benefits:

-

We helped the client to validate the newly developed Credit risk model for the purposes of PD PI for the CZ, SK branch.

-

Since PI is the largest segment of the bank, it was necessary to prepare and process a large amount of data

-

During the project, we prepared various checks that revealed deficiencies in the data, which were subsequently corrected.

-

We have successfully checked and tested the Development Documentation on the basis of which the Credit risk model will be implemented in practice.

-

The project was successfully submitted and approved by UCB headquarters